S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

23 May, 2025

By Tyler Hammel

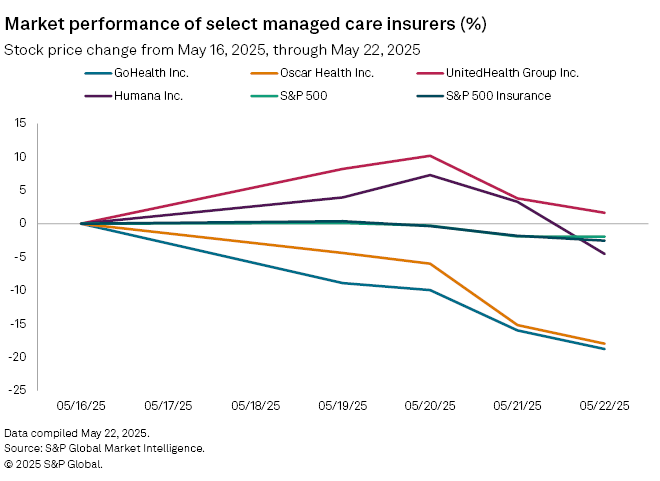

Shares in insurance technology companies GoHealth Inc. and Oscar Health Inc. were among the biggest losers over the last week following news of wider Medicare Advantage audits.

GoHealth experienced the largest drop among US insurance companies, falling 18.8% to $5.79 from $7.13 a share between May 16 and May 22. Fellow health insurtech Oscar Health also declined 18%, to $14.37 from $17.52 a share, S&P Global Market Intelligence data shows. These outpaced both the S&P 500 and S&P Insurance Index, which fell 1.95% and 2.23%, respectively, during the period.

The declines came after the Centers for Medicare and Medicaid Services (CMS) said it would significantly expand its Medicare Advantage auditing efforts, which involve adding 2,000 new employees. All eligible Medicare Advantage contracts for the payment years 2018 through 2024 will be audited beginning immediately, according to a news release.

"We are committed to crushing fraud, waste and abuse across all federal healthcare programs," CMS Administrator Mehmet Oz said. "While the administration values the work that Medicare Advantage plans do, it is time CMS faithfully executes its duty to audit these plans and ensure they are billing the government accurately for the coverage they provide to Medicare patients."

GoHealth and Oscar Health did not respond to Market Intelligence's requests for comment.

Legal scrutiny

The plan to expand scrutiny of Medicare Advantage comes just weeks after the US Department of Justice sued GoHealth, Humana Inc. and several other insurers and brokers, alleging they participated in a scheme that paid hundreds of millions of dollars in illegal kickbacks to brokers in exchange for enrollments into the insurers' Medicare Advantage plans.

Under the senior-aimed, government-subsidized Medicare Advantage (MA) program, beneficiaries may choose to enroll in healthcare plans offered by private insurance companies, and many rely on insurance brokers for help in selecting a plan.

"Rather than acting as unbiased stewards, the defendant brokers allegedly directed Medicare beneficiaries to the plans offered by insurers that paid brokers the most in kickbacks, regardless of the suitability of the MA plans for the beneficiaries," the DOJ said in a news release.

GoHealth denied the accusations in a May 7 news release, saying it has at "all times worked to advance the interests of the Medicare Advantage program and the Medicare beneficiaries it serves."

Additionally, GoHealth is facing an investigation by plaintiff law firm Cohen Milstein Sellers & Toll PLLC on behalf of investors due to the impact the DOJ lawsuit had on its stock price.

"On news of the DOJ's lawsuit, GoHealth's stock price fell $1.09 per share, or 10.35%, to close at $9.44 per share on May 1, 2025," a release from the law firm reads. "We are investigating GoHealth and certain officers and directors' conduct leading up to the stock drop."

Humana did not respond to a request for comment.

Q1 results

Despite the legal concerns facing GoHealth, it fared well during its first quarter, according to a research note from William Blair analyst Adam Klauber, who ranked GoHealth as "outperform."

GoHealth's first-quarter revenue grew 19%, ahead of William Blair's 14% estimate, Klauber wrote, pointing to new services offered by the insurer that could offset costs.

"We are positive on GoHealth's opportunity to leverage its existing scale by expanding into additional products," Klauber wrote. "While mix changes create greater uncertainty on the near-term trajectory of cash flow, we are encouraged by solid unit economics and believe the stock has good potential given GoHealth's position as one of the largest Medicare distribution platforms."

Oscar Health also had a strong first quarter, with net income rising year over year to $275.3 million from $177.4 million. Total revenue also increased over the period, to $3.05 billion from $2.14 billion.

Speaking at the company's May 7 earnings call, CEO Mark Bertolini expressed support for some of the CMS' recent policy changes while voicing opposition to others, including the shortened enrollment window, which he said constrains Americans' ability to shop.

"CMS' proposed program integrity initiatives targeting fraud, waste, and abuse are positive for the long-term sustainability of the market," Bertolini said on the call.

"Oscar advocates for constructive solutions that strengthen the individual market. We are engaged with federal and state policymakers on both sides of the aisle."

Large-cap concerns

While the two insurtechs, which both derive significant business from Medicare Advantage program, saw the most declines in the week, the audit also poses a challenge for larger insurers, according to a research note from J.P. Morgan analyst Lisa Gill.

"While it is difficult to size the full headwind from potential expanded [audits] ... we believe this could be an incremental headwind to [managed care companies]," Gill said, adding that among large-cap companies, Humana, CVS Health Corp. and UnitedHealth Group Inc. had the greatest exposure to the new CMS directive.

UnitedHealth welcomed the CMS' audit enhancements, saying, "We look forward to working with CMS to develop an accurate methodology and appropriately use advanced technology to greatly enhance the auditing process."

Humana was down 4.5% for the week while UnitedHealth rose 1.6% following a recent historic plunge over the last month.

In response to a request for comment, UnitedHealth referred to its previous public statements. CVS did not provide any comment and Humana did not respond.