S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

29 Jun, 2025

By John Wu and Beenish Bashir

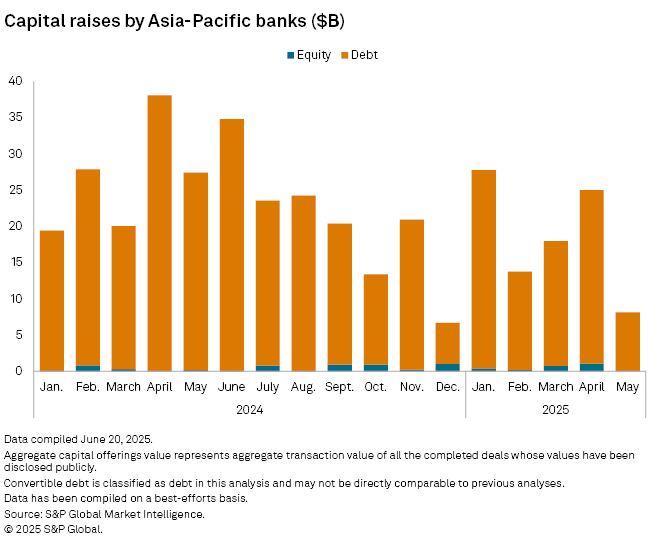

Capital raising by banks in Asia-Pacific fell for the fourth consecutive month in May amid volatile market conditions and global trade uncertainties.

Lenders in the region raised an aggregate capital of $8.13 billion, all in debt, in May, a sharp 70.2% year-over-year decline, according to S&P Global Market Intelligence data. The aggregate amount raised in May was the lowest so far in 2025 and extends a streak of year-over-year declines since February, data show. Measured over the previous month, capital raising by banks was 66.1% lower than in April.

"Mostly this is to do with [foreign exchange] volatility, trade uncertainties and bond vigilantes at work," said Filippo Alloatti, head of financials for credit at Pittsburgh-headquartered investment manager Federated Hermes. "There is also an element of crowding out, as most Western governments run large fiscal deficits, increasingly funded by government bond issuances."

Capital markets, including bonds, in Asia-Pacific somewhat stabilized in May after a volatile April, as the US and China entered a 90-day halt to their proposed tariff measures on imports from each other.

"The market is adopting a wait-and-see approach with limited conviction following the 90-day truce," said Chris Lau, senior portfolio manager at Invesco Fixed Income.

"Generally, economists have reduced their GDP forecasts across most regional economies, but they expect the Asian countries to remain resilient, supported by accommodative central bank policies and benign inflation," Lau said.

Asian central banks remain on divergent monetary policy cycles. The Bank of Japan is expected to raise rates further after it last hiked its benchmark policy rate to 0.50% from 0.25% in January. The People's Bank of China trimmed its key one-year loan prime rate by 10 basis points to 3.0%, while the Reserve Bank of Australia cut its cash rate by 25 bps to 3.85%, the second cut in 2025.

Beyond Asia-Pacific, the US Federal Reserve maintained its benchmark rate at 4.5% for the fifth month in a row while the European Central Bank cut its policy rate by another 25 bps to a two-and-a-half-year low of 2.15%.

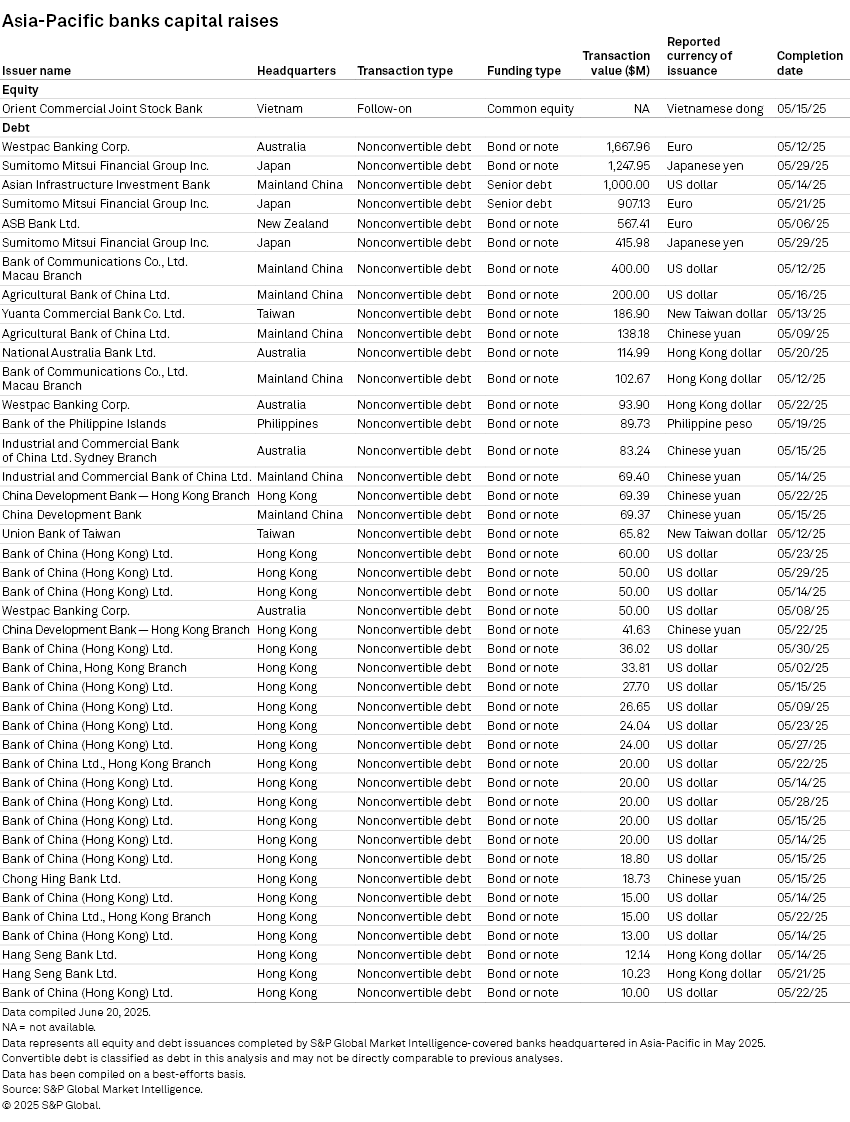

Australia's Westpac Banking Corp. raised $1.67 billion in nonconvertible debt, the biggest transaction in May. Japan's Sumitomo Mitsui Financial Group Inc. was the top issuer among banks in the region with an aggregate $2.57 billion via three deals, according to Market Intelligence data.

Other active debt issuers included large state-owned lenders in mainland China, such as Bank of Communications and Agricultural Bank of China Ltd., and the Beijing-based Asian Infrastructure Investment Bank, which raised $1.00 billion.