S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

25 Jun, 2025

By Tim Siccion and Neel Hiteshbhai Bharucha

The US and Europe have seen a rise in private equity investment from China and Hong Kong since the start of the year, though market observers expect this growth momentum to slow down amid increasing regulatory challenges and restrictions.

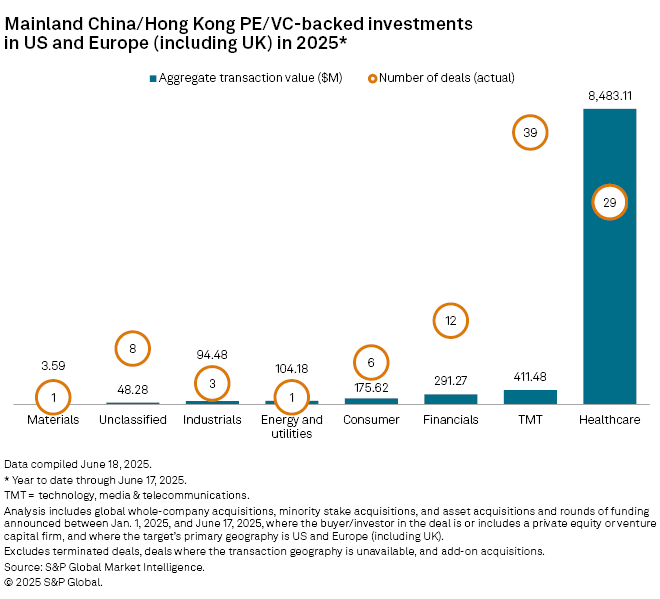

Outbound China and Hong Kong private equity and venture capital investment into the US and Europe, including the UK, amounted to $9.61 billion between Jan. 1 and June 17, already exceeding the $7.14 billion recorded in the full first half of 2024, according to S&P Global Market Intelligence data. In 2024, Chinese private equity flows to Western markets surged from 2023 levels.

"Chinese private equity is looking to the US and Europe for growth and diversification as China's domestic economy slows," said Ambarish Srivastava, Acuity Knowledge Partners (UK) Ltd.'s associate director of private markets.

Even with the uptick in deal value, Srivastava expects Chinese private equity investment in Western markets to slow in the next few years, especially Chinese capital targeting the technology sector and critical infrastructure projects in the US and Europe.

"In recent years, Chinese private equity firms have faced significant headwinds," Srivastava said, citing increased scrutiny and protectionism as notable obstacles. "Chinese private equity investments in the US and Europe may face heightened scrutiny over the next three to five years as each region evaluates its strategic priorities."

EU countries are more open to Chinese investments compared with the US.

"The European Union maintains an open policy for foreign direct investment, which has encouraged Chinese investments in Europe," Srivastava said. "France draws investments due to its high-skilled workforce, and its strategic sectors like technology and luxury brands."

Chinese investments in Western markets are likely to decline due to rising geopolitical tensions and regulatory hurdles, with private equity capital shifting toward Southeast Asia, the Middle East and central Europe, according to a Dezan Shira and Associates report in April.

– Download a spreadsheet with data featured in this story.

– Read up on trends in private equity carve-outs.

– Learn about private equity's push into retail investors.

From Jan. 1 to June 17, the healthcare sector was the biggest recipient of outbound Chinese private equity investment targeting Western markets, raising about $8.48 billion across 29 transactions.

The technology, media and telecommunications sector was a far second with $411 million, though it has the highest deal count with 39 transactions.

Largest Chinese PE deals in US, Europe

The HOPU Jinghua (Beijing) Investment Consultancy Co. Ltd.-backed $5.96 billion funding round for French pharmaceutical company Ceva Sante Animale SA is the largest Chinese private equity-backed deal in the US and Europe so far in 2025. Ceva Sante plans to use part of the proceeds to accelerate its research in animal health.

The second-largest deal in the year through June 17 was a $411 million series A round for UK-based biotechnology company Verdiva Bio Ltd. from investors including Eli Lilly Investment Consulting (Shanghai) Co. Ltd. Verdiva will use the funding to advance the clinical development of its existing assets, among other functions.

The third largest was a $400 million series D round for US biotechnology company Eikon Therapeutics Inc., with participation from Hong Kong-based E15 VC.