S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

25 Jun, 2025

By Yuzo Yamaguchi and Marissa Ramos

Mergers and acquisitions among Japanese regional banks may accelerate as they seek scale to benefit from higher interest rates amid a declining population.

Deal activity has increased in recent months. Daishi Hokuetsu Financial Group Inc. and The Gunma Bank Ltd. announced plans in April to consolidate their operations, following The Chiba Bank Ltd.'s acquisition in March of a nearly 20% stake in The Chiba Kogyo Bank Ltd. Also in March, The Shizuoka Bank Ltd., The Yamanashi Chuo Bank Ltd. and The Hachijuni Bank Ltd. entered into an agreement for a comprehensive business alliance.

"[Regional banks] are seeking to boost assets and revenue in a world of interest rates," said Eiji Taniguchi, a senior economist at Japan Research Institute (JRI). "During periods of negative interest rates, deposits were unnecessary for them, but now, they are eager to secure deposits potentially through M&A to earn higher margins." Taniguchi views the recent deals as indicative of a growing trend in the consolidation of regional banks.

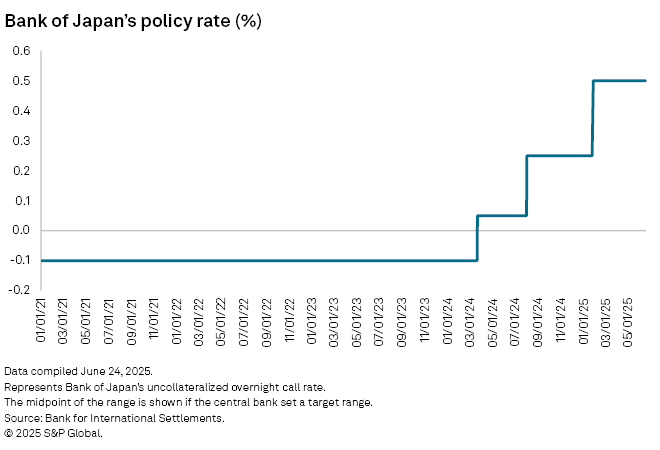

Japanese regional banks are rushing to improve their ability to acquire deposits as they prepare for more interest rate hikes after the Bank of Japan's exit from its negative rate policy in 2024. In addition to scale, M&A deals may allow lenders to build expertise for digital transformation and for diversification into investment or matchmaking of local customers.

"A merger of regional banks should also have the positive impact on local economies," said Hideo Oshima, another senior economist at JRI. "They [regional lenders] need to improve services for customers and keep them from shifting to digital and megabanks," which are expanding their digital banking businesses with a focus on the retail market.

Government support

The Japanese government supports regional bank consolidation by offering a conditional subsidy of up to ¥3 billion to lenders that agree to merge. It is now considering extending the subsidy for another five years and increasing the amount after it expires in March 2026, a spokesperson for Japan's Financial Services Agency said.

"They [regional lenders] are in healthy conditions for now," the spokesperson said. "But given that they are facing a population issue, the consolidation should be a major option for them to consider navigating this challenge."

The population of Japan's 47 prefectures, except Tokyo, is estimated to decline by 5% to 15% or more from 2020 to 2035, according to an analysis by the National Institute of Population and Social Security Research. At the same time, loans are estimated to decline by more than 5% in 18 prefectures from 2022 to 2030, weighed down by a declining population and slow economic growth, according to Mitsubishi Research Institute.

"The declining population served as a driver of the consolidation [of regional banks], and mergers are expected to continue," Takahisa Funaki, a senior researcher at Mitsubishi Research Institute's financial consulting division, said in an email.

Growing threat

Regional banks, particularly smaller ones, are in a weaker position than the three Japanese megabanks — Mitsubishi UFJ Financial Group Inc., Sumitomo Mitsui Financial Group Inc. and Mizuho Financial Group Inc. — to pass higher financing costs on to borrowers as they have to support local businesses, JRI's Oshima said.

"They [regional banks] are now facing a growing threat from megabanks and digital banks," Oshima said.

As a result, regional lenders are struggling to boost deposits.

Combined outstanding deposits at 61 regional banks inched up 0.9% year over year to ¥333.890 trillion as of March 2025, compared to a 2.2% increase in the prior fiscal year to ¥330.962 trillion, according to data from the Regional Banks Association of Japan. On the other hand, combined deposits at the megabanks rose 2.7% in the most recent fiscal year to ¥590.2 trillion, following a 4.6% increase to ¥574.8 trillion in the prior fiscal year, according to statements from the megabanks.

The challenging times would also offer opportunities for major financial institutions to acquire regional banks.

"We're planning to put regional banks into our group," said Yoshitaka Kitao, CEO of SBI Holdings Inc., which has already invested in nine local banks. "Otherwise, they [regional banks] can't stay in business," Kitao said during a June 16 press conference.