S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

27 Jun, 2025

By Tom Jacobs

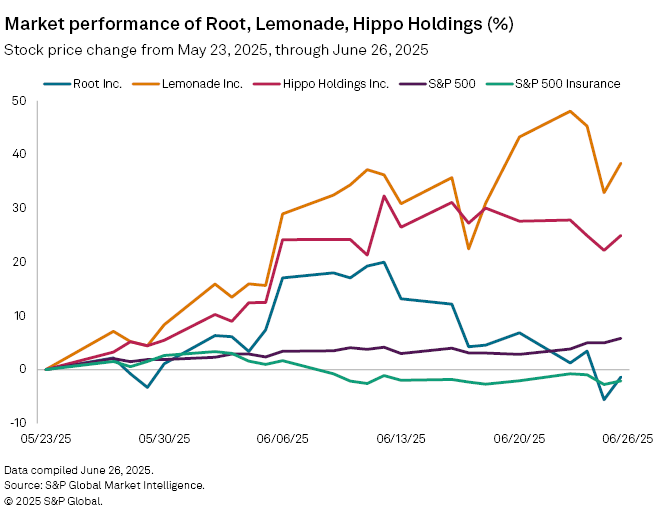

Lemonade Inc. and Hippo Holdings Inc. are finishing the quarter strong on Wall Street, with the two insurance technology companies' shares jumping more than 20% in the past month.

Lemonade's stock improved 38.42% by market close June 26 to $42.80 from $30.92 on May 23. Hippo, headquartered in Palo Alto, Calif., saw a 24.98% boost in its stock over the same period, rising to $27.92 from $22.34.

Root, another listed US insurtech, fell 1.39% over the same period, while the S&P 500 improved 5.83% and the Nasdaq Composite was up 7.63%. The S&P 500 Insurance Index was down 2.10% over the period.

Lemonade's surge in the market is likely due to the recent improvement in the broader markets, said Keefe, Bruyette and Woods analyst Tommy McJoynt.

"You've seen a broader market rally with some fintech, technology and crypto names all doing well over the past month or so," McJoynt said in an interview. "Historically, those have also resulted in some buying power for a name like Lemonade as well."

Controlling the narrative

Headquartered in New York, Lemonade offers renters and homeowners insurance, as well as auto, pet and life insurance products in the US and Europe. The company has acknowledged profitability issues, stating in its latest Form 10-K that it has not been profitable since its inception in 2015 and has recurring cost-control issues.

Despite that, Lemonade's stock has shown recent improvement, aided by the insurer's "ability to articulate their story," said Kaenan Hertz, managing partner for Insurtech Advisors.

Lemonade saw a year-over-year increase in revenue, according to its first-quarter results, but posted a loss of 86 cents per share, which beat the S&P Capital IQ consensus of 93 cents.

"An earnings beat, whether it's still losing 86 cents or 93 cents, is still an amazing beat in the eyes of their ability to spin it," Hertz said in an interview. "So I think there is some excitement in the marketplace that says, 'Hey, they're good.' They are master articulators of their story."

McJoynt said Lemonade's positive performance on Wall Street happened despite little change from the company over the past six months.

"So [the improvement] does appear just to be sentiment-driven rather than an actual expectation for any sort of like estimates or earnings revisions to be higher," McJoynt said.

Hippo "getting smarter"

Hippo, which provides insurance for home and condominium owners and landlords, has also struggled with profitability. It booked its first quarter of positive net income in the fourth quarter of 2024, but reported a net loss in the following quarter, fueled by losses from the January wildfires in Los Angeles.

Hertz said Hippo has worked hard on addressing those profitability issues through strengthening its property and casualty subsidiary, Spinnaker Insurance Co. He also cited a recently announced partnership with The Baldwin Insurance Group Inc., which President and CEO Richard McCathron said during the company's June 12 investor day "triples our access to builders throughout the US."

"[Executives] talked about ... becoming smarter at risk management and a commitment for Spinnaker to provide more capacity," Hertz said. "That's partially why I think the marketplace started to react more positively to Hippo was around what they heard at the investor day."

Lemonade and Hippo declined to comment for this story.

Root cause

The story behind Root's relatively minor setback in the market could be as simple as cashing in on the stock's impressive returns, according to McJoynt.

The stock price is up 76.1% for the year and, in just over a year, has gone from $7.35 on Feb. 7, 2024, to an all-time high of $177.69 on March 24, 2025. McJoynt said it is tough to pinpoint exactly what is driving the downturn, other than chalking it up to profit-taking.

"There is a sensitivity to tariffs, just as it applies to all the other auto insurers," McJoynt said. "But what is most sensitive for Root is [investors'] outlook for their growth in policies and policy counts, and they're competing with The Progressive Corp., GEICO Corp. and The Allstate Corp."

Root did not respond to a request for comment.

Overall, Lemonade "hasn't even come close to making anything close to a profit ... and is still a story in progress," Hertz said. Meanwhile, he said Root "has figured it out" and is now a profitable insurer.

"If you think about it in agricultural terms, right, Root is past the planting stage and is in the growing stage, and they have a healthy field," Hertz said. "Lemonade, I think, is still struggling to turn the seeds into plants."