S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

11 Jul, 2025

By Hailey Ross

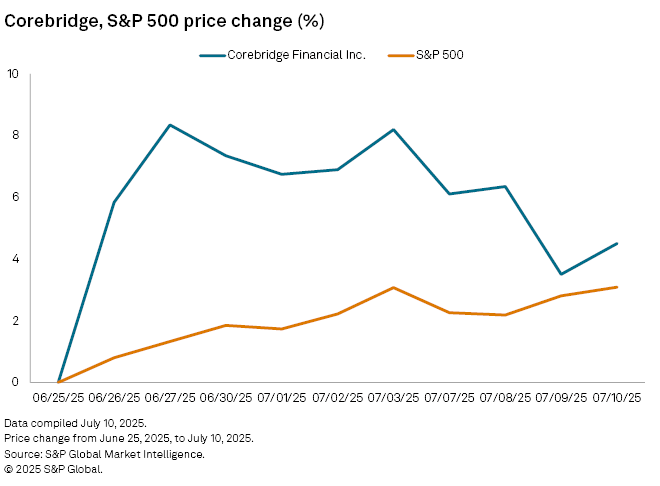

Corebridge Financial Inc.'s share price has outperformed the broader market since it announced a multi-billion dollar deal on June 26 in which a Venerable Holdings Inc. unit will reinsure all of the variable annuities in Corebridge's individual retirement business.

The transaction is worth $2.8 billion, which is comprised of both ceding commission and capital release, and Corebridge ultimately expects it will result in about $2.1 billion of net distributable after-tax proceeds for the company.

Corebridge's share price hit a peak of $35.83 at the close of business on June 27, an 8.35% increase from its close of business price of $33.07 on June 25. The stock's price has since fallen, but it is still outperforming the broader market which has experienced trading volatility in recent weeks. Corebridge's share price from June 25 through close of business July 10 was up 4.5% while the S&P 500 was up 3.1%.

In a note, TD Cowen analyst Dan Bergman said the transaction will reduce tail risk for the company, better its growth outlook, and unlock value.

"We view Corebridge's deal to reinsure its entire VA block as a significant positive, as it monetizes arguably the company's highest-risk [and] lowest-multiple business at a valuation above where the stock was trading," Bergman said.

Shifting focus

The transaction itself reflects a full exit from variable annuities in Corebridge's Individual Retirement business, which had a client account value of about $51 billion as of March 31, 2025. Individual Retirement is just one of Corebridge's four business segments.

During a June 26 deal call, Corebridge CEO Kevin Hogan said that variable annuities have historically been a "growth engine" but enthusiasm for them has faded over the years in favor of other products.

"The Individual Retirement variable annuity portfolio has had significant net outflows for eight years with a generally declining earnings contribution," Hogan said, adding that the deal represented a "timely opportunity to monetize an underappreciated and undervalued book of business" at an attractive valuation.

As Corebridge shifts focus away from variable annuities in Individual Retirement, Hogan said that he sees a "very robust environment" for the company's index products, saying that fixed annuities also continue to be "attractive."

New variable annuity contracts written through the Individual Retirement business and issued through Corebridge's subsidiary American General Life Insurance Company will be reinsured with an "ongoing flow reinsurance agreement" set to kick in upon completion of the transaction.

Jeffries analyst Suneet Kamath said that he, too, takes a "positive view" of the transaction, and reiterated a buy rating on Corebridge in a note.

"While we've argued that Corebridge's VA block is higher quality relative to others in the market, we also feel it created an overhang on its valuation in a 'guilt by association' kind of way," Kamath said. "Post the deal, Corebridge's Individual Retirement segment should be viewed as a spread-lending pure play, which we feel deserves a higher price-to-earnings multiple."

A spokesperson for Corebridge declined to comment beyond the public statements that the company has issued related to the transaction.

Corebridge will report its second-quarter results after market close Aug. 4 followed by an earnings call at 10 a.m. ET Aug. 5.