S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

14 Jul, 2025

Two of Japan's largest property and casualty insurers saw a significant jump in profits for fiscal 2024, even as projections for the sector are less bullish for the coming year.

Tokio Marine Holdings Inc. expects ¥930.0 billion of net profit for the fiscal year ending March 2026, equivalent to a year-over-year decline of 11.9%. The profit forecast is based on an assumption that net incurred losses related to natural catastrophes in Japan for the upcoming fiscal year will amount to ¥106.0 billion, while losses from outside Japan will total ¥93.0 billion.

The insurer also projected ¥1.100 trillion of adjusted net profit for fiscal 2025, driven by the expected continuation of strong performance at the group's key international entities as well as auto insurance rate increases at its Japan property and casualty business.

MS&AD Insurance Group Holdings Inc. expects a net profit of ¥579.0 billion for fiscal 2025, representing a decrease of ¥112.60 billion year over year. The insurer also projected group adjusted profit of ¥671.0 billion for the period, representing a year-over-year decrease of ¥60.70 billion due to an expected reduction in gains from the sale of strategic equity holdings.

Sompo Holdings Inc., which intends to voluntarily adopt the International Financial Reporting Standards (IFRS) for its consolidated financial statements, said its forecasts for fiscal 2025 were prepared based on IFRS.

The insurer expects ¥335.0 billion of net profit for the fiscal year ending March 2026, which represents a ¥91.0 billion increase from its IFRS-revised net profit figure of ¥243.0 billion in the fiscal year ended March 2025. The forecast is based on an assumption that net incurred losses at Sompo Japan Insurance Inc. related to domestic natural disasters will amount to ¥110.0 billion during the year.

Sompo Holdings also expects its adjusted consolidated profit to be ¥363.0 billion in fiscal 2025, representing a year-over-year increase of ¥39.0 billion from its IFRS-revised adjusted profit of ¥323.0 billion in fiscal 2024.

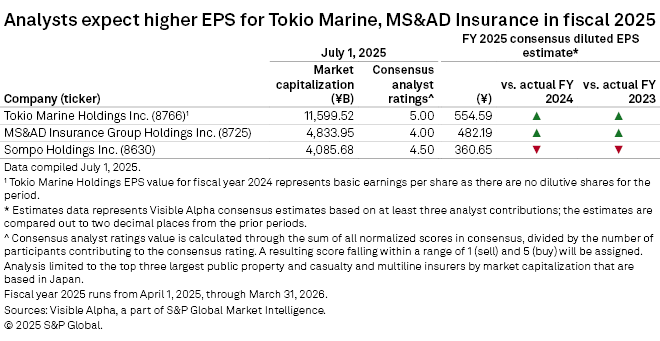

In contrast with the insurers' projections, analysts expect Tokio Marine and MS&AD Insurance to record higher earnings per share in fiscal 2025.

The consensus EPS estimate for Tokio Marine is ¥554.59, according to data from Visible Alpha, a part of S&P Global Market Intelligence. Tokio Marine reported net income per share of ¥542.16 in the fiscal year ended March 2025.

For MS&AD Insurance, the consensus EPS estimate is ¥482.19 for fiscal 2025. This is higher than its actual reported net income per share of ¥445.45 in fiscal 2024.

Meanwhile, analysts' consensus EPS estimate for Sompo Holdings is ¥360.65, lower than the insurer's ¥436.45 net income per share in fiscal 2024.

– Use the screener to access financial results on the S&P Capital IQ Pro platform.

– Read an analysis of the largest insurers in Asia-Pacific in the second quarter, based on market capitalization.

– Read about potential M&A activity in the global insurance sector on In Play Today and a summary of recently announced deals on M&A Replay.

MS&AD Insurance, Sompo post record profits in fiscal 2024

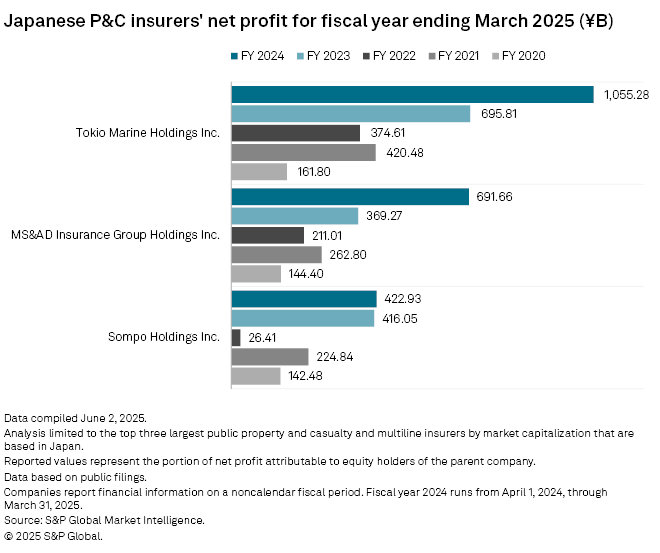

Tokio Marine's net profit climbed 51.7% to ¥1.055 trillion in fiscal 2024, which ended March 2025, compared with ¥695.81 billion in the previous fiscal year. Adjusted net profit also increased year over year to ¥1.215 trillion from ¥711.60 billion, benefiting from the accelerated sales of business-related equities and the resulting significant increase in gains from the sale of equities, along with strong performance by key international entities and decreased large losses in the Japan property and casualty business.

MS&AD Insurance reported a record net profit of ¥691.66 billion for the fiscal year ended March 2025, up 87.3% from ¥369.27 billion the previous year. The insurer attributed the growth to increased investment income at its domestic non-life insurance business and increased income at its Americas and international life insurance businesses. Group adjusted profit was a record ¥731.70 billion, up from ¥379.90 billion the previous year.

Sompo Holdings' net profit increased 1.7% year over year in fiscal 2024 to ¥422.93 billion from ¥416.05 billion. Despite the smaller growth compared with other members of Japan's "Big 3" property and casualty insurers, Sompo still described 2024's performance as a "record" year. Adjusted consolidated profit climbed year over year to ¥334.30 billion from ¥291.0 billion, driven by increased investment income at the overseas business.

Domestic, international growth

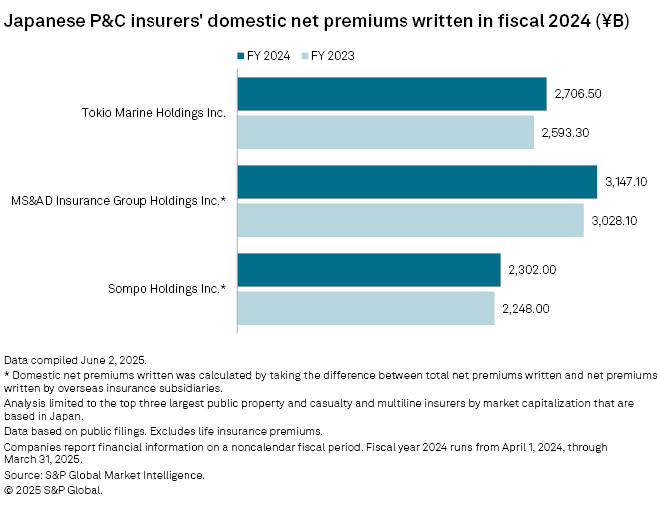

The three insurers continued to see growth in net premiums written from their domestic businesses during the period. MS&AD Insurance reported the largest with ¥3.147 trillion, up from ¥3.028 trillion in the previous fiscal year.

Mitsui Sumitomo Insurance Co. Ltd. and Aioi Nissay Dowa Insurance Co. Ltd. in particular reported ¥3.110 trillion of combined net premiums written in fiscal 2024, compared with ¥2.992 trillion a year ago. The increase was driven by the voluntary auto line of business and the fire and allied line of business.

Net premiums written at Tokio Marine's domestic business increased year over year to ¥2.707 trillion from ¥2.593 trillion, driven by premium and product revisions for the fire and auto insurance lines of business as well as expanded sales in specialty lines.

Sompo Holdings recorded ¥2.302 trillion of net premiums written from its domestic business in fiscal 2024, up from ¥2.248 trillion a year ago. Sompo Japan saw a ¥63.1 billion year-over-year increase in net premiums written due to the impact of product revisions in the auto and fire lines of business and increased sales in casualty lines.

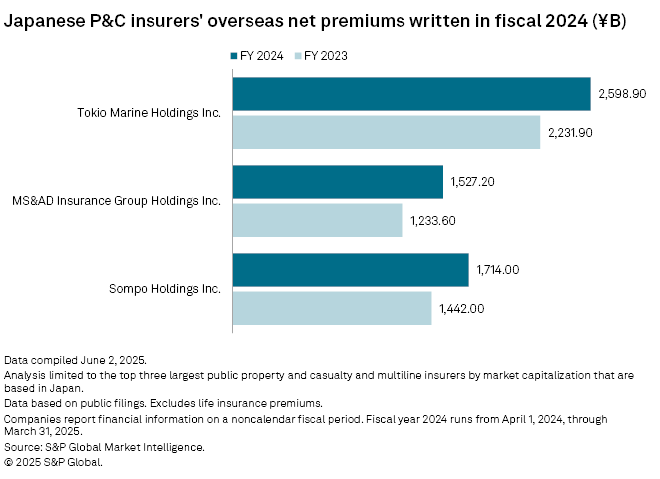

Strong performance at Tokio Marine's international business, driven by a steady rate increase and expanded underwriting, led to ¥2.599 trillion of net premiums written during fiscal 2024. In comparison, Tokio Marine's international business recorded ¥2.232 trillion of net premiums written in the previous fiscal year.

Net premiums written at MS&AD Insurance's overseas non-life insurance subsidiaries amounted to ¥1.527 trillion in fiscal 2024, up 23.8% from ¥1.234 trillion in fiscal 2023. The growth was due to an increase in new business, driven by diversification across multiple product lines and a share increase at the Lloyd's and reinsurance business segment.

Sompo Holdings' overseas business logged ¥1.714 trillion of net premium written in fiscal 2024, up from ¥1.442 trillion in the previous fiscal year.

As of July 14, US$1 was equivalent to ¥147.53.